In the Cattle Markets: Corn and Feeder Cattle Price Relationship

By: Brenda Boete, University of Wisconsin-River Falls

Historically feeder cattle prices have been determined by several factors, with corn price and fed-cattle price having the greatest impact. The corn price has typically had an inverse relationship to both fed and feeder cattle prices. This means, as the price of corn increases, the price of feeder cattle decreases. This assumes that all other factors have remained constant, including other feeding costs as well as fed-cattle price.

Several years ago, Dillon Feuz wrote an article for In the Cattle Markets on the relationship between corn and feeder cattle prices. For that quick analysis, Dr. Feuz wanted to examine a historical idea that a $0.10 decrease in corn prices resulted in a $1/cwt increase in feeder cattle price. For 2007-2011 he found overall feeder cattle prices were less responsive to changes in corn prices than historically thought. Given the current strong forecast for U.S. corn production, and the new crop corn at $3, it is interesting that there has been almost no upward response in the feeder cattle market. In this newsletter, I want to revisit the question of what is the relationship between corn and feeder cattle price, and see if this relationship has changed again in recent years?

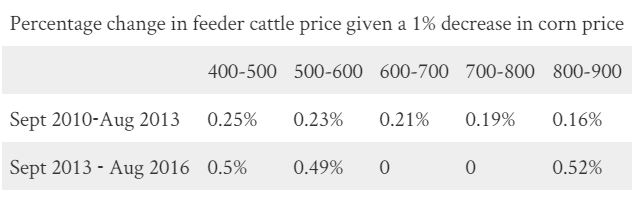

I looked at weekly feeder cattle prices from Oklahoma from September 2010 through August 2016. I broke the data into two time periods: September 2010 through August 2013 and September 2013 through August 2016. I used the current nearby corn futures for each month and used the live cattle futures 8 months out for 4-600 lb. feeders and 4 months out for 6-900 lb. feeders. I found that from September 2010 through August 2013, the corn and feeder cattle relationship appeared as expected, with feeder cattle price sensitivity to corn price declining as weights increased. For September 2013 through August 2016, this relationship no longer held as heavy weight (800-900 lbs) feeder cattle price is the most sensitive to changes in corn price. Additionally, feeder cattle price for cattle weighing 600 – 800 lbs is found to be not affected by changes in corn price as the coefficients are not statistically significant. The table below shows the percent change in feeder cattle price associated with a one percent change in corn price.

This model was a quick analysis to see if and how the industry is changing. More research needs to be done regarding the change in relationship between feeder cattle price and corn price. A lot of current forecasting is done today assuming this inverse relationship betweencorn and feeder cattle price holds. Additionally, most price slides used assume that heavy weight feeders are less responsive to changes in corn price than light weight cattle. This analysis did not examine causes for the change in the relationship. That question can be addressed at a later date.

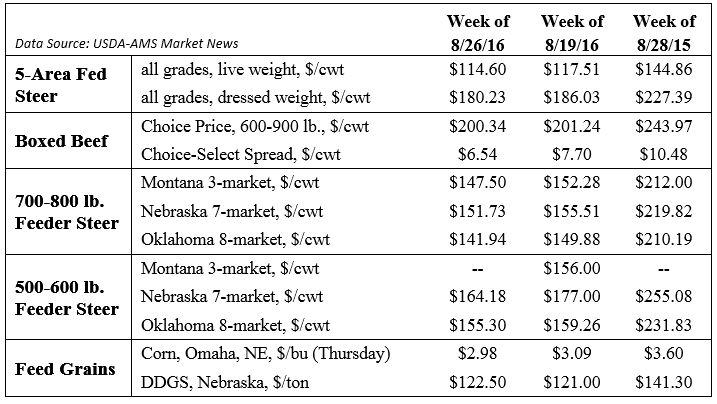

The markets

Futures ended Tuesday 75 cents to $2. 40 higher. USDA reported the average of last week's cash trade at $114.60, down $3 from the previous week. The October contract lost about

$3.50 last week, while cash prices weakened. Even with the upcoming Labor Day weekend, packers have been struggling to move beef. On Monday, wholesale beef prices dropped $1.06 (Choice) to $1.23 (Select) and packers moved only 118 loads of product amid the sharply lower prices Monday.

Corn prices have continued to decrease. The stronger dollar as well as the decline in wheat and soybean futures prices has continued to keep corn prices declining. The December contract fell to its lowest level since September 2009. Crop conditions are well above the 5- year average; however, some analysts have begun to lower their estimates on corn yield.