Choosing Pasture, Rangeland, Forage Rainfall Index (PRF-RI) Insurance Coverage

November 15, 2014 is the deadline to purchase or change coverage for the 2015 calendar year.

By: Matthew Diersen, Professor & Risk/Business Management Specialist, SDSU Extension

Pasture, Rangeland, and Forage (PRF) insurance is available for 2015 in South Dakota based on a Rainfall Index (RI). Haying and grazing needs can be covered against moisture shortages using PRF-RI. November 15, 2014 is the deadline to purchase or change coverage for the 2015 calendar year. While producers would prefer to be paid if they did not have forage, PRF-RI relies on a relationship between rainfall timing and forage production amounts. Producers insure against low precipitation during specific intervals for localized grids that ideally match haying or grazing needs.

According to the Census of Agriculture there were 22.5 million acres in permanent pasture and rangeland across South Dakota in 2012. In addition, there were also 1.4 million acres of other (non-alfalfa) hay harvested in South Dakota in 2014. Such hay would be ineligible for Forage Production insurance, but eligible for PRF-RI insurance. However, only 1.2 million acres were insured with PRF-RI in 2014 across grazing and haying. The premium subsidy is comparable to other crops and the historic loss ratio is favorable for insured parties, suggesting more acres would be covered.

The coverage available in South Dakota mirrors pasture rents for grazing. The coverage price level ranges from $8.80 to $38.23 per acre depending on the county. The coverage price level is $276.80 per acre for haying across counties. In the event that precipitation is low during an insured interval, producers could use indemnity payments to purchase replacement feed. The coverage price level does not have a harvest adjustment feature.

Ideally, a producer will know key months that a lack of precipitation would result in less forage production. There are many ways to allocate coverage and not all acres need to be insured. Selected acres are allocated across 11 two-month intervals that cannot overlap a given month. At most 70% and no fewer than 10% of acres can be included in a single interval.

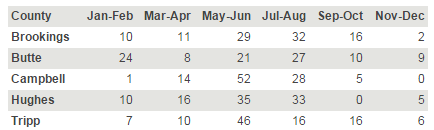

For risk reduction, spreading out coverage across intervals is a good starting point. If a producer wants to concentrate the coverage, selecting higher loadings for specific intervals becomes more challenging. The losses from historic hay shortfalls were bundled in a portfolio with insurance intervals across several South Dakota counties (see table). Intervals that include higher weights for May through August minimized the difference between haying losses and indemnity payments. Thus loading coverage in key months would give insurance payouts when needed to offset haying shortages. Grazing data are not available in a similar format, but at recent workshops the consensus was that shifting loadings a little earlier in the year makes sense to capture similar risk-reducing effects.

Table 1. PRF-RI interval weights (shares by selected intervals) that minimize the difference between haying losses and indemnity payments across selected counties in South Dakota.

Note: Only the intervals shown were analyzed. Weights cannot be less than 10% for a given interval. Having weights below 10% shows the marginal ability to reduce risk.

Premiums for PRF-RI vary by county, type, coverage level, practice/interval, and grid location. Rainfall is grid-level and not farm- or ranch-level when measured. Producers have to pick a coverage level from 70-90% of the grid base. Most acres in South Dakota are covered at the 90% level despite its lower subsidy rate. Producers also have to pick a productivity level from 60% to 150% of the county base. Many producers say the base grazing rates do not reflect their cost for renting grass, suggesting the use of higher productivity levels. This allows for intra-county variability in soil type, grade, and forage type.

More Information

For more information, interested insurable parties can contact a crop insurance agent or go on-line to the RMA website. In addition, there are two related factsheets: