CAB Insider: Credit End Meats With CAB® Value-Add

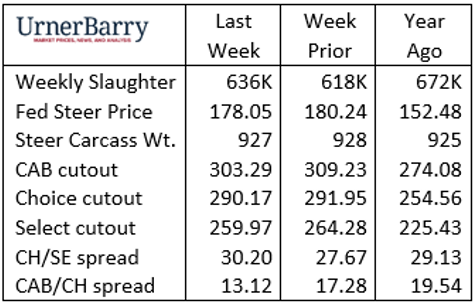

Fed cattle prices have been under pressure for the past two weeks with yet another $2.19/cwt. average decline in last week’s fed steer values. This culminates into a two-week downward adjustment of $7/cwt. in cash fed cattle prices.

The now month-old October 1st Cattle on Feed report, with a surprising increase in September placements and October 1st feedlot inventory numbers, has generated much response in CME Live Cattle futures trading. While a degree of price pessimism is expected when cattle supply metrics make unexpected upward moves, many agree that the extent of the downward shift is overdone.

The November 1st Cattle on Feed report, published last Friday, was more aligned with analyst expectations. As a result it did not create a dramatic move in futures trading.

On the other side of the coin, packer margins remain negative and wholesale boxed beef prices continued to pull lower in last week’s averages. This fundamental information should be much more pertinent to weekly spot cattle prices than the volatile futures market. Unfortunately for cattle feeders, these conditions don’t build a case for upward price expectations.

Boxed beef activity last week saw lower prices across most of the beef cuts as packer supplies were adequate and buyers acknowledged the brief shift of focus toward Thanksgiving. This allowed beef prices to settle.

Rib prices tend to reach their annual peak in November, as the small volume of uncommitted supplies trade on sharp holiday demand ahead of December. Last week’s Certified Angus Beef® brand average heavy-rib price was 3% lower than the prior week, suggesting the high had already been put in place. Yet, yesterday brought increased interest and upticks in price so we’ll watch with interest for the next two weeks.

CAB® tenderloin values are near record, all-time highs as last week’s $18.10/cwt. wholesale price was just a few cents cheaper than two weeks earlier.

Credit End Meats With CAB® Value-Add

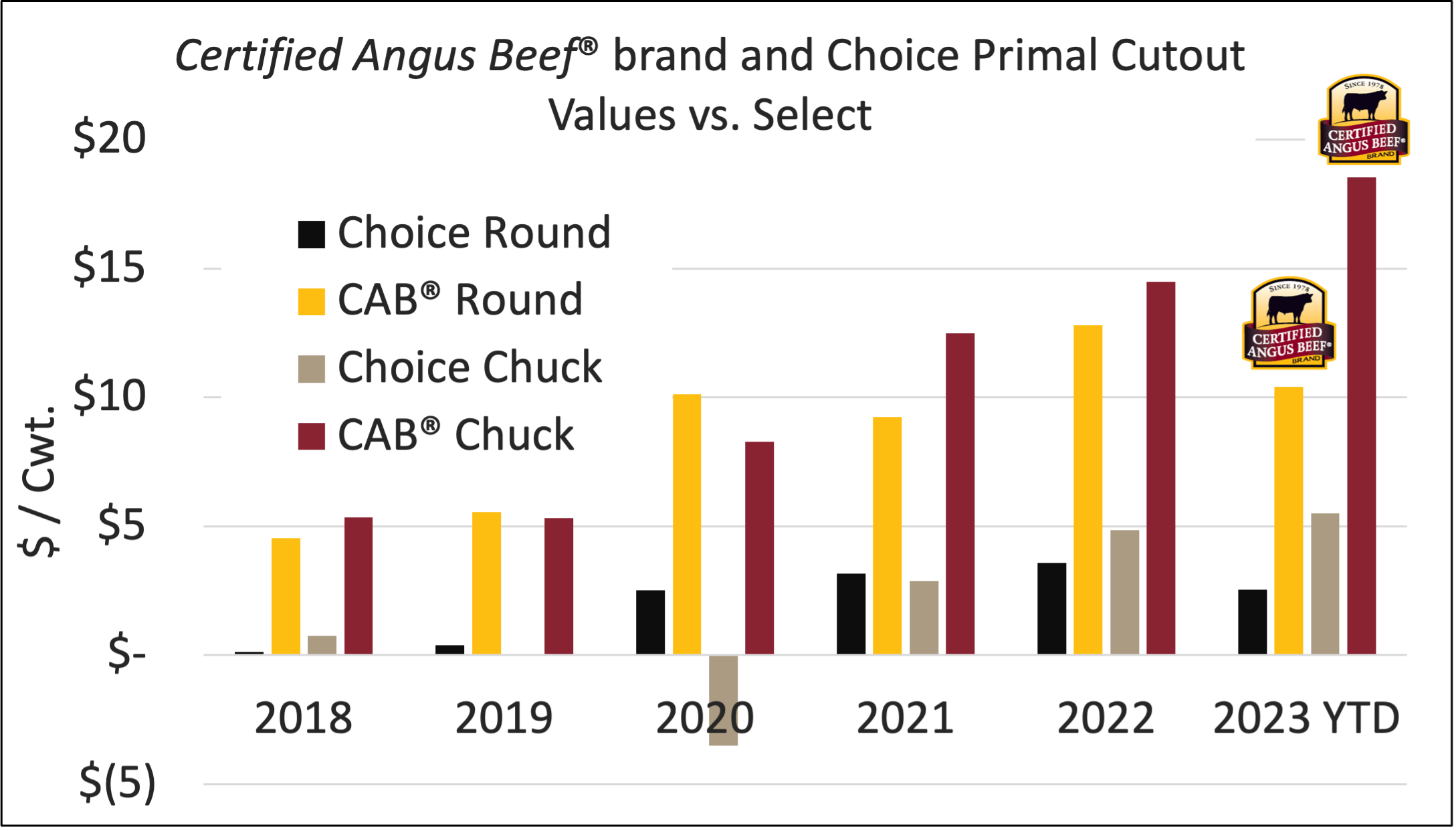

We focused on fourth quarter middle meat demand as a beef price driver in the last edition of the Insider. This is certainly the case in the current data as rib and tenderloins are pricing near their annual highs. However, a look at annual price trends across the beef carcass shows increasing contributions to CAB premiums from both ends of the carcass.

The chart shows widening price spreads between Select, Choice and CAB® end meats as they are summarized by total value per hundredweight in both the chuck and round primals. The cutout values represented by the bars show both the USDA Choice and CAB® values for the chuck and round primals in relation to USDA Select. Notice that in 2018 and 2019 the Choice premium over Select is virtually indiscernible, well below $1.00/cwt. for both Choice chuck and round items for each of those years. In 2020 the Choice round value began to build a premium over Select with a $2.50/cwt. value that would increase in the following two years. Despite this, the Choice chuck price somehow notched a $3.51/cwt. discount to Select in 2020 before correcting and building rapidly into 2023.

One of the unique attributes about the Certified Angus Beef® brand is that fact that value creation through premium attributes and branding is not isolated to the middle meat steaks and roasts. Indeed, both the CAB® rib and loin primals carry a larger price premium than the chuck and round. However, the higher trending premiums derived from the less famous end meats are to be credited with a good portion of the increasing total carcass cutout premium that CAB® brand carcasses command today.

Comprising 29.6% and 22.3% of total carcass weight, respectively, the chuck and round are the heaviest primals, followed closely by the loin at 21.3%. This means that while the premium per pound is much smaller for the end meat primals, total dollars per carcass are not insignificant. The chuck, weighing more than the round and commanding a higher premium per pound wins the day, generating a $33.99 premium per-head over Choice and $48.32 per-head over Select so far in 2023.

CAB® round primal cutout premiums are not quite as attractive but still increasingly adding value where USDA Choice has, until most recently, struggled to find any price differentiation from Select. In 2023 the total carcass premium contribution from the CAB® round has been $15.44 per head over Choice and $20.44 per head above Select.

This year cuts from the round have pulled back slightly in value in proportion to total carcass value. The pullback is only to the degree of half of a percentage point, yet the lighter demand also set the CAB® round premium contribution slightly lower than a year ago. However, the the CAB® chuck premium is at its largest ever at $13.05/cwt. over Choice.